Where Are All The .400 Investors?

How to Become a Stock Market Billionaire

Warren Buffett is almost certainly the most studied investor in history. His annual letter to shareholders is probably the most widely read financial publication each year, tens of thousands attend the Berkshire Hathaway annual meeting to hear him speak, and a search on Amazon for his name turns up over 2,000 results in “Books”.

There is little mystery as to why people are interested in what he has to say: after a lifetime of shrewd investing, he is now the sixth richest person in the world, even after giving away two-thirds of his fortune to charity. We hope that by studying what he has done and listening to what he says, we might glean a bit of wisdom that will help in our own quest for investment riches.

There is an interesting related puzzle here, one that sometimes comes up as a job interview brainteaser: Why aren’t there more Warren Buffetts out there?

It is true that there is only one Jeff Bezos, and only one Elon Musk, but in aggregate, there are a lot of extremely wealthy tech company founders. Today, the roster of the nine richest Americans consists of Warren Buffett and eight tech founders: Bezos, Musk, Gates, Ballmer, Zuckerberg, Ellison, Page and Brin are each listed by Forbes as having a net worth between $60 and $180 billion.

The pattern holds if you go through the entire Forbes 400 list, even down at the bottom, where the average net worth is only around $2 billion. Almost everyone is either an entrepreneur or inherited a fortune made by an entrepreneur.

In fact, there is not a single person besides Buffett in the Forbes 400 that made their money directly through profitable passive investments in publicly traded companies. True, there are some hedge fund managers and venture capitalists on the list, but they made most of their fortunes through the generous fees they charge their investors, not through the direct returns on their investments.1 There appears to be no investor that is even 1% as successful as Warren Buffett.

Put another way, if indeed “r > g” (the famous argument from the economist Thomas Piketty that returns on capital in excess of economic growth has driven wealth inequality), why didn’t any of the richest people in America derive their fortunes from “r”?

There are some tempting explanations that do not hold up under closer scrutiny. One is that Buffett’s unique success is attributable to his unique longevity; his definitive biography, written by Alice Schroeder, is entitled The Snowball, after an analogy describing the power of compound interest over a long period of time.

However, Buffett was already in the top 100 of the very first Forbes 400 list compiled in 1982, when he was only fifty-two years old and just thirty years into his career. He first made the top ten in 1988, and even back then, he was very unusual for having made the list as a stock investor.

Another objection might be that he does sometimes cut private deals with companies, opportunities not available to the average investor; however, these never made up a material portion of Berkshire’s net worth, nor did they account for any of his most profitable investments.

Yet another theory is that his legendary thrift accounts for his outlier success, but he has given away the majority of his wealth and has flown on private jets for years.

Still others point out that the extent of his wealth today is in part a function of the epic increase in stock valuations since the early 1980s, but that doesn’t explain his relative performance, as we have seen that he was already one of the richest men in America before the stock market took off.

We will try to approach this question another way, by doing a case study of another Forbes 400 investor, looking for commonalities with Mr. Buffett, in search of the “secret sauce” that leads to outlier investment results.

“He turned $50,000 into $900 million. Insurance stocks, mostly.”

Shelby Cullom Davis lived most of his life in anonymity, and might be totally unknown today if not for his son, also named Shelby Davis.2

His son had a remarkable career as a professional money manager, starting at the Bank of New York in the late 1950s, where he rose to be the youngest VP in the history of the firm since Alexander Hamilton. In 1969 he founded Davis Advisors, and by the early 2000s, he had accumulated an exceptional performance record and tens of billions of dollars under management.

His track record attracted the attention of the financial writer John Rothchild, who had previously co-written the investment classic One Up On Wall Street with the legendary Fidelity manager Peter Lynch. Rothchild’s original idea was to write a book about the son, but the son persuaded him to shift his focus to his father.

Unlike the son, the father did not manage money for others, but rather merely turned $50,000 into $900 million by investing some of his personal funds in insurance stocks. Rothchild agreed that this might be a good story, and the resulting book, The Davis Dynasty, is the main source for this case study.

It turns out that father and son had a sometimes difficult relationship, and never really collaborated professionally during their careers. The son was one of the most successful investors of his generation, but the father put up one of the most remarkable investing records of all time.

Shelby Cullom Davis began in 1947 with $50,000 ($600,000 in 2020 dollars), and by 1988, Forbes ranked him as the 197th richest person in America, with a fortune of $370 million (nearly $1 billion in 2020 dollars).

In some ways, Davis’s success was just as impressive as that of his contemporary, Warren Buffett. By 1988, Buffett was the tenth richest American, with a fortune of $2.2 billion. Buffett and Davis started investing around the same time, but Buffett managed money professionally in the beginning of his career. Buffett earned performance fees from the money he managed, and in 1969, when he wound up his partnership and focused on Berkshire, those performance fees accounted for a big portion of his $25 million fortune at the time.

By contrast, Davis made his fortune purely by investing his own money in the stock in publicly traded insurance companies and watching his wealth grow. No management fees, no performance fees, no buyouts, just undervalued securities and the power of compounding.

So who was Shelby Cullom Davis?

Shelby Cullom Davis wrote and published a bi-weekly newsletter throughout his 40+ years as an investor. It covered insurance stocks, and he wrote it and printed it and mailed it faithfully to his brokerage clients, week after week, year after year, decade after decade, even though reader response was nearly nonexistent.

As he got into his 80s, his grandson helped him produce his newsletter. One day he asked his grandfather, “Why do we bother with this when nobody reads it?”

His grandfather responded, “It’s not for the readers. It’s for us. We write it for ourselves. Putting ideas on paper forces you to think things through.”

Warren Buffett himself has written a newsletter for over six decades, although it is annual instead of biweekly, and he has been known to give similar advice in the past. Perhaps writing a newsletter is the key to investing greatness?

It makes sense that Davis would write a newsletter for most of his life, for in his first career, he was a professional writer and journalist. (This is not an unheard of path to starting a successful investing career - Mike Moritz moved from Time to Sequoia.)

In 1932, after graduating from Princeton with a history degree, Davis was traveling to graduate school in Geneva when he met a journalist on his boat who offered him a job with CBS Radio in Europe. He would work there for a few years while he finished his degree. (Later in his life, he would return to serve as the U.S. Ambassador to Switzerland under Nixon and Ford.)

He returned to the States to work as a freelance writer for publications including The Atlantic, which he was able to manage financially because of the wealth of his in-laws, who owned a major carpet manufacturer in Philadelphia that would eventually be sold to Mohawk. However, he struggled to find work, and made a short detour into finance, to serve a stint as a stock analyst for his brother-in-law’s investment firm.

He soon returned to writing, completing a book entitled America Faces the Forties, which argued that capitalism was the solution to the Depression, not the cause. His book caught the eye of Thomas Dewey, the Governor of New York, and Davis went to work for Dewey as a speechwriter and advisor during Dewey’s unsuccessful 1940 presidential campaign.

Davis again returned to writing after the campaign, but when Dewey won a new term as the Governor of New York in 1944, he appointed Davis as deputy superintendent in the New York State insurance department.3 While serving in this role, Davis studied the insurance industry in depth and concluded that insurance stocks represented the bargain of a lifetime.

Dewey was the favorite to win the Presidency in 1948 (although ultimately Dewey did not defeat Truman), but despite the upward political trajectory of his boss, Davis left in 1947 to pursue his fortune in the insurance business.

Davis was an unlikely candidate to become one of the most successful investors in history. His background was in writing and politics, and he started his investing career late in life, at the age of thirty-eight. By contrast, Buffett started investing when he was a teenager and launched his first investment partnership at the age of twenty-five.

Davis decided that the best way to leverage his knowledge of insurance was to buy a small brokerage firm and pitch the virtues of insurance stocks to investors around the country. The plan was that investors would be persuaded and place their orders through his firm, and he would make a profit on commissions and underwriting fees for new offerings.

This turned out to be a terrible plan. Insurance stocks were cheap precisely because most investors at the time refused to buy them, and his firm was never terribly profitable. (Around the same time, Buffett also endured a challenging stint as a stockbroker, trying to convince Omaha investors to buy shares of GEICO.)

Regardless, after buying the brokerage firm and a seat on the NYSE for $50,000, Davis had $50,000 left over to buy insurance stocks. (A lesson from the Sam Walton school: if you want to get really rich, it helps to start by marrying rich.) As he had correctly concluded, insurance stocks were incredibly cheap, with high quality firms trading at four times earnings and a fraction of book value. By comparison, the S&P 500 today trades at twenty-two times forward earnings.

A look at Warren Buffett’s analysis of GEICO from 1951 gives a sense of the market environment for insurance stocks at the time. Buffett observes that GEICO has a unique model of selling directly to policyholders rather than through agents, which allows it to sell policies at discounts of up to 30% and still achieve profit margins of 28% (vs. the 7% average of its peers).

He notes further that GEICO was a true growth company, having tripled the number of policyholders in the last five years, and with significant room to grow. (At the time, GEICO had 144,000 policyholders; today, it has 17 million.) And it was trading at only eight times earnings!

If that sounds cheap, consider that just three years prior, in 1948, an investment partnership had acquired a 50% stake in GEICO from an existing investor for a mere $712,500. That investment valued GEICO at less than book value and also less than two times the earnings GEICO would record in 1949.

Like Buffett, Davis was a disciple of Benjamin Graham, a Columbia University professor and investment manager who wrote the book on security analysis (the book, first published in 1934, is appropriately entitled Security Analysis). Graham is widely considered the father of modern investment analysis.

In 1949, Graham published another investment classic, The Intelligent Investor; later editions include a postscript recounting that around the time of the initial publication, his investment partnership acquired a 50% stake in a promising insurance company. He marvels that he and his partners made far more money on this investment in GEICO than on all of the other investments he made in his entire career, combined. (The initial investment of $712,500 produced profits of over $300 million by the time he completed the fourth edition in 1972.)

Buffett studied under Graham at Columbia and worked for him briefly at his investment firm, Graham-Newman, while Davis knew Graham and served as president of the New York Society of Security Analysts (NYSSA), an organization founded by Graham to promote the fledgling profession.

From his recent experience as an insurance regulator, Davis brought with him a deep understanding of the insurance business and insurance accounting. He also put in the effort to visit potential investments and rigorously interview management teams, at a time when that was not yet common practice. (So did Buffett.)

Later on, in his 1979 letter to shareholders, Warren Buffett would write that the insurance business “tends to magnify, to an unusual degree, human managerial talent - or the lack of it”. Davis understood this well, and his ability to select good management teams - or in Davis’s words, to “separate the bluffers from the doers” - played a major role in his exceptional investment returns.

And what returns they were. His $50,000 investment in 1947 had grown to nearly $10 million by the end of 1959 ($92 million in 2021 dollars), a 200-fold return in thirteen years. That works out to an astounding 50% per year compounded - an amazing result for a diversified portfolio of public companies over a meaningful period of time.4

His returns over that period can be attributed, in approximately equal parts, to high market returns, superior security selection, and the use of margin debt - a confluence of factors that combined to produce a lollapalooza result.

The S&P 500 returned 17% per annum over that period, for a total return of 8x, as investors returned to the market in the wake of the Great Depression and WWII, and trading multiples expanded. That amount would be reduced to 13% after-tax, or 5x, if we assume a 25% tax rate.

Without the use of margin debt, Davis would have made about 30% after tax per year, for a total return of 30x.5 The difference between a 30x return and an 5x return is the impact of his superior security selection, or alpha.

It is his use of margin debt that really put him over the top, from 30x to 200x. He tended to borrow on a one-to-one basis, that is, for every dollar of equity he owned he would borrow a dollar, so for example when he started with $50,000, he borrowed another $50,000, so he could invest $100,000. As his stocks appreciated, he was able to take out larger loans and buy more stock.

This had the effect of turbocharging returns, but only by adding an additional source of risk. Turbocharging works both ways; a market drawdown can force a margin call, in which the lender can force an investor to sell cheaply to repay outstanding debt, even if it means wiping out the investor completely.

The most recent example of the dangers of margin is Archegos, the family office which owned a concentrated equity portfolio on margin and left their lenders with major losses after it collapsed. Archegos reportedly operated with much higher leverage - four-to-one, rather than one-to-one, so it only took a small decline to wipe it out - but the principle is the same.

His investment returns during this period brought him an early dose of unwanted fame and opened a rift in his relationship with his children. He had invested $4,000 for each of his two children in the early 1940s, back when they were toddlers; by 1961, they were now young adults, and their investment accounts had grown to $3.8 million each ($35 million in 2021 dollars).

Davis wanted to give a gift to Princeton, his alma mater, and he decided the best way to fund the gift was to demand that his daughter, Diana, sign over her entire fortune. (Diana wanted to marry someone Davis didn’t approve of.) Diana naturally objected, and Davis, with no legal recourse, tried to force her hand by hiring a PR firm to portray her as a greedy ingrate in the New York tabloids. “I fear what Diana needs is a good spanking,” Davis told the press.

Diana fought back in the media and the press took her side, but she and her brother were humiliated. They eventually agreed to allow their father to donate all but $1 million of each of their inherited fortunes to end the public squabble, but the family relationship never fully recovered. Money does not always buy happiness.

As an investor, Davis was just getting started. Bargains in American insurance stocks were becoming scarcer, but he discovered that insurance companies overseas offered incredible value. In 1962, he began to invest heavily in Japanese insurers, which were highly profitable and which were trading as low as two times earnings. As the Japanese market boomed, so too did his wealth, which multiplied another five times between 1959 and 1965, to nearly $50 million (over $400 million in 2020 dollars).

There was no Forbes list back then, but it is quite likely that at this point, a mere eighteen years into his investing career, his $50 million fortune already qualified him as one of the 400 richest Americans. (Membership to the inaugural Forbes list in 1982 required a net worth of only $75 million, equivalent to only $25 million in 1965 dollars.)

His diversification into foreign stocks helped him survive the difficult period from 1966-1974, a period in which the S&P 500 had a total return of zero, despite high inflation. Davis’s portfolio fared even worse, shrinking from $50 million to $20 million, bitten by a pullback in insurance stocks and amplified by his use of margin.

The stock market bounced back strongly from the 1974 lows, and so too did Davis. The market returned 8x from 1975-1988, and Davis’s portfolio did even better, going from $20 million to over $370 million in 1988, at which point he made the Forbes list. His biggest winners were companies he had held since the 1960s or earlier: AIG, Berkshire Hathaway, and his core Japanese holdings.

Many of his holdings would continue to outperform the market beyond his death in 1994. His stake in Berkshire alone, worth $50 million at his death, would be worth over $1 billion today, and at least one of his smaller holdings, Progressive, grew to be a giant.

The Davis story makes for an interesting case study, but has little in common with Buffett’s story, aside from the shared link with Graham. The most obvious commonality between them is their shared interest in the insurance business, which we will turn to next.

The insurance business would seem like an unlikely place for two of the most successful investors ever to make their fortunes. For one, the aggregate profits and returns on capital of insurance companies were fairly mediocre during this period. A comprehensive study was published in 1968 showing the poor returns of insurers as a whole during this time, much to the consternation of the insurance industry, which had initially funded the study, expecting to find the opposite.

Buffett has written extensively on the difficult economics of the insurance business:

"The insurance industry is cursed with a set of dismal economic characteristics that make for a poor long-term outlook: hundreds of competitors, ease of entry, and a product that cannot be differentiated in any meaningful way.” (1987)

“In such a commodity-like business, only a very low-cost operator or someone operating in a protected, and usually small, niche can sustain high profitability levels.“ (1987)

"Insurance companies offer standardized policies which can be copied by anyone. Their only products are promises. It is not difficult to be licensed, and rates are an open book. There are no important advantages from trademarks, patents, location, corporate longevity, raw material sources, etc., and very little consumer differentiation to produce insulation from competition." (1977)

An insurer takes in money today with a promise to pay out claims in the future. Insurers must charge enough for their policies to cover the direct cost of future claims, as well as to cover their operating costs - agents, claims adjusters, actuaries, etc.

As if this were not difficult enough, there typically exists a period of time between when they collect the premium and pay out claims; they must hold and invest this so-called “float” and collect investment income. As Graham remarked in Security Analysis, an insurance company represents “a combination of the insurance business and the investment-trust business”.

An insurer thus has multiple ways to fail badly, in ways that are not likely to be discovered until years after the initial mistakes are made. We earlier examined the case of GE, which acquired some small insurance companies for a few hundred million dollars in the 1990s, and two decades later was facing $15 billion in losses from mispriced policies written for long-term care. (There can be quite a long feedback loop in many types of insurance, and the losses from mispriced policies can become quite large.)

Insurers also sometimes fail when they invest their float in securities that go bad. AIG actually managed to fail during the financial crisis by losing money on both sides; they lost tens of billions of dollars writing mispriced default insurance on mortgage-backed securities, and separately they lost billions more on the mortgage-backed securities they owned, purchased with the collateral they received in their securities lending program.6

An episode that involved both Davis and Buffett illustrates the unique challenges of the insurance business. In the early 1960s, Davis became interested in GEICO, which as we discussed previously, is a rare example of a low-cost operator; they sell directly to consumers, bypassing agents, giving them a much lower cost to acquire customers, which in turn allows them to offer lower premiums and earn higher margins. Davis would become the largest shareholder of GEICO and also a member of the GEICO board.

In the 1970s, under a new management team, GEICO expanded into higher risk customers. They began to seriously underestimate losses on the policies they were writing, which caused them to set their prices far too low. The premiums they charged were no longer covering their costs.

GEICO had been profitable for its entire history, the result of cautious underwriting and its low cost of customer acquisition; even as losses from claims mounted, their underwriting and marketing expenses still remained at 14% of premiums written, far lower than the 28% average for the industry.

In 1975, GEICO was finally forced to recognize that its loss estimates had been far too low for years. They reported an underwriting loss in that year of $190 million, an amount greater than its entire shareholders’ equity, and a dramatic reversal for a company that had recently been reporting pretax income of nearly $30 million a year.

The stock plummeted from $61 in 1972 all the way to $2 in 1976. Teetering on the edge of bankruptcy, GEICO brought in a new CEO, Jack Byrne.

Buffett had been following the company, and he advised Byrne that besides raising prices and pulling back on new policies, he needed to aggressively raise capital to shore up GEICO’s financial position. Believing that GEICO could emerge again with its low-cost advantage intact, he had Berkshire begin buying stock and promised to invest in future capital raises, and enlisted Salomon to lead a stock offering.

Davis felt that the scale of the proposed capital raises would be too dilutive, and sold all of his stock, which had since recovered to $8, taking a major loss. Berkshire eventually invested $45 million for a third of the company, a stake that would grow to 50% over the years as GEICO returned to profitability and repurchased stock with their excess cash.

In 1995, Berkshire agreed to spend $2.3 billion to acquire the remaining half of the company, for a split-adjusted $350 per share. Today, GEICO is the largest auto insurer in the country, and based on the market value of its comparable rival, Progressive, it is worth at least $50 billion today.

GEICO was Davis’s worst investment disaster, and at the time, it was Buffett’s biggest investment victory. Davis regretted selling out of GEICO for the rest of his life and never directly reinvested, though as a consolation, he still owned it indirectly through his stake in Berkshire (he held 3,000 shares, or 0.3% of the company).

This goes to illustrate the importance of diversification, but it also highlights Buffett’s earlier point about the tendency for the insurance business to magnify human managerial talent, or the lack thereof. It only takes a few years of poor underwriting discipline for even a cost-advantaged operator to come close to failing completely.

Rothstein quotes David Schiff, author of Schiff’s Insurance Observer: “Our industry is populated by an assortment of buffoons, jobbernowls and chuckleheads.” The corollary to this observation is that faced with such competition, a talented and disciplined management team has the potential to achieve exceptional results.

It can be very profitable to invest in an industry where overall returns are average, if the dispersal of returns is very high, and if you have an edge in predicting which firms will be the top performers. Buffett and Davis both figured out that well-managed insurers were both identifiable (at least to some extent) and frequently deeply undervalued.

Buffett has stated in the past that the insurance industry has been more immune to other types of risk, such as obsolescence risk. Rothstein points out that many leading insurers today have been around since the 19th century, or even longer. Insurance companies frequently adopt new technology, but technology has not made them obsolete, at least to date. This is another factor that perhaps causes investors to undervalue insurance companies from time to time.

Buffett and Davis both made enormous profits in the insurance industry, but with almost no overlap in their investments, besides Davis’s small portfolio position in Berkshire later in his career. Davis made the core of his insurance fortune by 1965, and many of his biggest winners were overseas. Buffett did not make his first big foray into insurance until 1967, with the acquisition of National Indemnity.

However, both shared a similar approach to the insurance business, emphasizing the importance of picking insurance companies with talented and disciplined management. Buffett regularly sings the praises of the managers of his insurance subsidiaries, which have consistently delivered superior underwriting results. Berkshire’s insurance subsidiaries also have the added advantage of having Warren Buffett available to manage their investments.

While there are investing lessons to be learned from analyzing how Buffett and Davis approached the insurance business, it seems that their shared interest in insurance is not the common factor either. Buffett’s spectacular pre-Berkshire success had nothing to do with insurance. Even at Berkshire, his returns came as much from investments in quality businesses as they did from his wholly-owned insurance subsidiaries. We must look elsewhere for an explanation.

In 1986, Harvard paleontologist Stephen Jay Gould7 wrote a now-famous essay entitled “Why No One Hits .400 Any More”. In baseball, a .400 hitter is a hitter who gets a base hit in 40% of their batting opportunities over the course of a season. Traditionally, only the very best hitters in the game managed to achieve a mark above this threshold.

At the time the essay was written, however, it had been forty-five years since anyone had hit .400, the last being the Red Sox great Ted Williams, who hit .406 in 1941. Gould observes that this presents a bit of a paradox; if athletes are supposedly getting better over time, why can no one can hit .400 anymore?

Gould has a simple explanation. Players stopped being able to hit .400 because baseball players keep getting better. A hitter’s ability to get a base hit is also a function of the fielding and pitching he faces, which has improved over time as well.

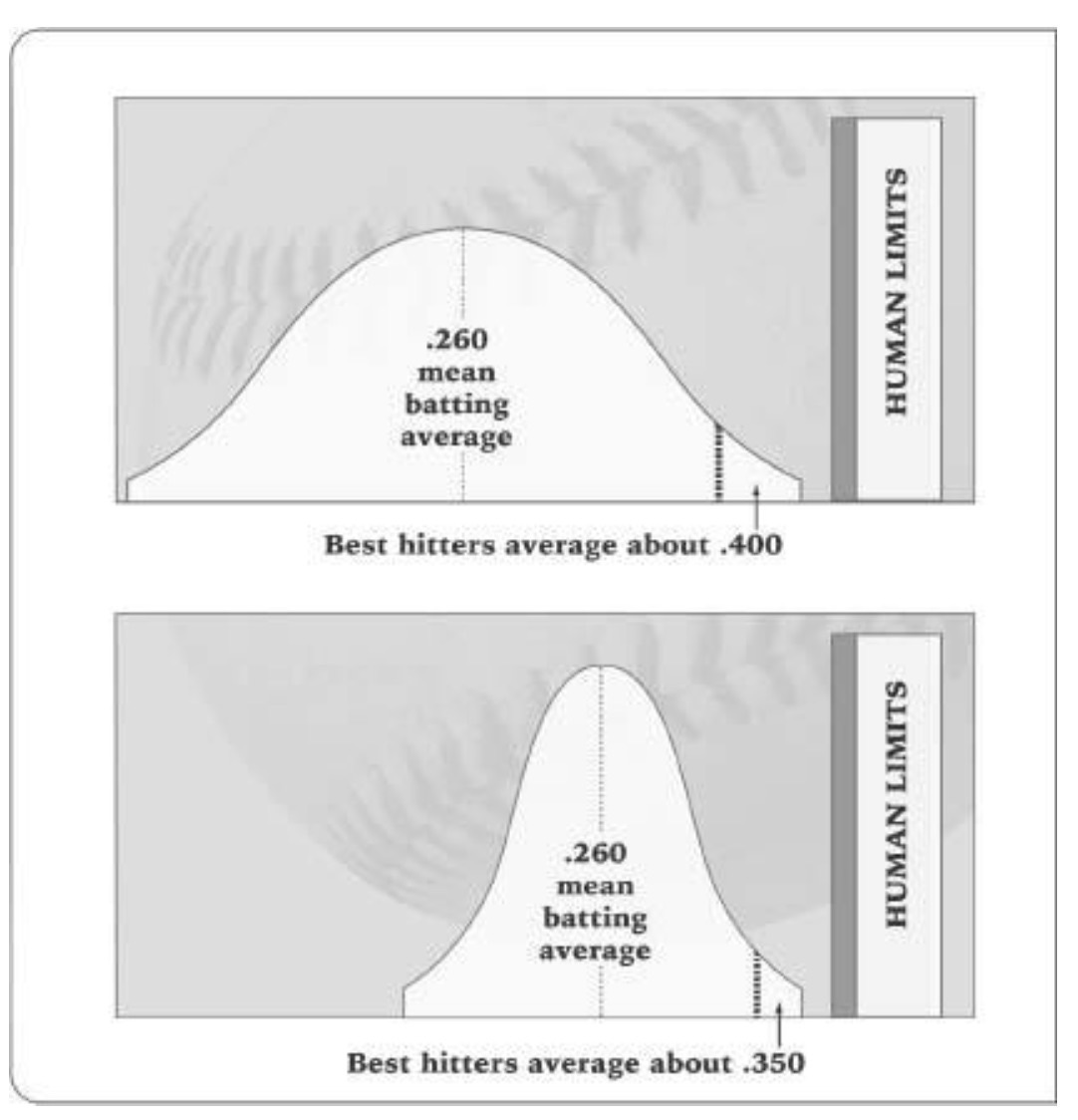

The average hitter has hit about .260 since the inception of the modern game in the 1890s, a mark that has been held in place over time through various rule changes that keep the game in balance. Gould observes that it is the variation of batting average among players that has declined.

Gould points out that back when players regularly hit .400, baseball was riddled with inefficiencies. Fielders didn’t know where to position themselves, and most pitchers didn’t throw very hard. By today’s standards, the average player wasn’t very good, and so it was possible for the best players to hit more than 140 points above the average. On the other end, there were a number of very bad players who hit for a very low average, as Gould demonstrates in this graphic:

Since the best players were already close to the limits of what could be achieved, as players got better and inefficiencies disappeared, the gap between the best hitters and average hitters shrank, as he shows here:

As his theory would predict, no one has come close to hitting .400 in the thirty-five years since his essay was published, and it is possible that no one will ever hit .400 again.

Passive investing, like hitting, is (more or less) a zero sum game. Davis was able to build a fortune by purchasing undervalued insurance stocks for ten cents on the dollar, but that was only possible because there were people willing to sell at those prices, investors who did not understand the true value of what they were parting with and who were effectively transferring their wealth to him.

What Davis and Buffett have much in common, but what is most relevant to our puzzle is not their shared interest in insurance or their approach to investing or their use of leverage. It is when they began investing. Davis and Buffett began investing at a time when knowledge about security analysis was far less widely disseminated and most assets were not yet professionally managed, and thus the variation of returns was very high.

They were both students of the father of the discipline, Benjamin Graham, a man who made his fortune by paying only two times earnings for a highly profitable, fast growing company that was on its way to being the industry leader for decades to come. Today, Tiger probably would have outbid him with an offer that was a thousand times larger.

Forbes did not come up with the idea to publish a list of wealthy Americans until 1982, but there is evidence that passive investors made up a much larger share of the roster of wealthiest Americans in generations past. Jay Gould, the speculator who became one of the richest men of the late 19th century, famously said: “I don’t build railroads. I buy them.” Hetty Green, the “Witch of Wall Street”, was by far the wealthiest woman in America, having amassed a fortune of over $100 million by her death in 1916 (over $2 billion in 2021 dollars) by investing her million dollar inheritance in undervalued stocks and bonds.8

Even back in the 1980s, Buffett had more peers who had accumulated comparable wealth directly through passive stock investing. The 1988 list that ranked Buffett tenth with a fortune of $2.2 billion, and Davis 196th at $370 million, also contained Henry Singleton (96th, $590 million), who delivered incredible returns as the CEO of Teledyne by repurchasing stock and buying undervalued securities through the 1970s and 1980s.

In 1950, only 8% of public equities were managed by institutions, a share that grew to 20% by the 1970s and 67% in 2010. The rise of professional investing and the dissemination of knowledge about how to value companies made for a more efficient market, but also made it harder to accumulate a fortune by buying cheap stocks. (The rise of professional investing did make it easier to accumulate a fortune through management fees, however.)

We can see this by comparing Berkshire’s performance in the early years and more recently. Someone who invested a dollar in the S&P 500 in 1965 (when Buffett took over Berkshire) would have $7.38 by the end of 1987, an annual return of 9.1% compounded. A dollar in Berkshire invested in 1965 then was worth $238 by the end of 1987, a compounded return of 26.8%. That works out to be an outperformance of 17.7 percentage points per year.

A dollar invested in the S&P in 1988 would be worth over $31 by the end of 2020, for an annual return of 11.0%, while a dollar invested in Berkshire in 1988 grew to be worth $110, for an annual return of 15.8%. Buffett’s outperformance therefore narrowed to only 4.8 percentage points per year.

There is a major confounding factor here, which is that Berkshire was working with a much larger pool of assets by 1988, and thus a much smaller investment universe, making it much harder to outperform. However, as no doubt he was a much better investor by the 1990s than he was in the 1960s, so it is not much of a stretch to imagine that a measure of his decreased outperformance is due to a more competitive environment.9

When Ted Williams hit .406 in 1941, it was not at all apparent at the time that he would be the last to cross .400; it was reasonably common for hitters to hit .400 before 1920, and the mark had been achieved as recently as 1930. Decades later, when the true magnitude of his accomplishment became clear, Williams joked that if he knew it was such a big deal, he would have done it more often.

There will continue to be investors who make a billion here or there on a single big trade or an early investment in the next trillion dollar company, but it will probably never again happen that a Shelby Davis or Warren Buffett will become one of the wealthiest Americans by assembling and managing a buy-and-hold portfolio of passive investments. In all likelihood, Warren Buffett is the Ted Williams of investing; the greatest of his generation, and perhaps the best of all time,10 but also someone whose legend will be greatly enhanced by the more competitive environment that followed.

Unlike baseball and passive investing, entrepreneurship is not a zero-sum game. Successful entrepreneurs are in the business of creating new goods and services and more efficient means of production. A more competitive environment for entrepreneurs does not dilute returns in the same way it does for investors; more entrepreneurs can mean more wealth.

The economics of superstars applies to superstar entrepreneurs just as it does to superstar entertainers; both can now easily reach and monetize billions of people over the internet, rather than be confined to national or local audiences. While the most talented passive investors must be content with more modest returns, successful entrepreneurs will grow even wealthier.

The competitive conditions that reduce returns for investors also directly raise the share of the pie available to entrepreneurs and employees. When he founded GEICO in 1930, Leo Goodwin had to give away 75% of the company to raise $75,000 (equivalent to $1.2 million today). Terms for entrepreneurs had improved enough by the 1990s that Jeff Bezos and his family still owned 51% of Amazon after an $8 million Series A and a $54 million IPO.

Buffett has always been a bit of an outlier in the investing world, but there are actually extreme outliers in entrepreneurship, too, in a way that is not entirely captured by the Forbes list. Microsoft managed to go public without really raising much money from investors; if Bill Gates had not already donated most of his fortune to charity, today he would be worth not $124 billion as reported by Forbes, but over $900 billion. (That’s something that the “buy, borrow, die” crowd can chew on for a bit.)11

One can think of entrepreneurship as the process of predicting what new games will have huge rewards in the future, and developing a big edge before the game becomes more competitive and efficient. Finding the next big market early is equivalent to playing baseball in the 1890s or buying stocks in the 1940s - you can put up huge results even if you don’t have world-beating talent, and if you do have world-beating talent, watch out!

That is not to say there is nothing to be gained by studying the most successful capital allocators of the past. While the specific tactics can become outdated quickly - it is no longer possible to buy quality companies at two times earnings, or to make double digit unlevered returns in merger arbitrage - analytical frameworks and psychology are timeless, and applicable to fields outside of security analysis.

The lesson here is simple: if you really want to become a billionaire in today’s world, don’t bother trying to find cheap stocks, just start a company. You are a thousand times more likely to succeed.

Further Reading: Adam J. Mead recently wrote a complete financial history of Berkshire Hathaway, and he maintains an archive with Berkshire-related public filings and annual reports. The site includes GEICO annual reports dating back to the 1960s, which was an invaluable resource for that part of this essay.

Michael Mauboussin has also written about Gould’s model as it relates to investing, and how it relates to the paradox of skill.

One partial exception worth mentioning is the fortune amassed by the partners who run Renaissance Technologies (RenTec), profiled in Gregory Zuckerman’s recent book The Man Who Solved the Market. However, this fortune appears to be derived from trading securities, not from investing in them. As a thought experiment, imagine the market was closed for a year; investors would continue to make money but RenTec would not. RenTec therefore seems to be a special case.

Shelby Cullom Davis’s grandfather and namesake was Shelby Moore Cullom, who served as Governor of Illinois and later represented Illinois for five terms in the Senate.

Note to overseas readers: In America, insurance companies are primarily regulated by the individual states.

He tended to average about eight major holdings and 20-30 total holdings, with relatively little trading.

This is my best estimate based on the data available, anyway.

This is just a summary; Roddy Boyd’s Fatal Risk tells of the collapse of AIG in detail.

Gould was an incredibly prolific writer and a well-known public figure, so much so that he was featured in a classic episode of The Simpsons. Sadly, he passed away in 2002.

Forbes did publish some shorter lists of rich Americans back then — here is one from 1918 which includes a number of financiers.

It should be noted that his outperformance from 1988-2020 was much more enriching to his shareholders. His 17.7 percentage point outperformance before 1988 translated to maybe $7 billion of alpha, adjusted for inflation (at the time, Berkshire’s unrealized gain in GEICO alone was worth 20% of Berkshire’s market cap!), but the much larger base later on meant that that his 4.8 percentage point outperformance was worth over $400 billion (Berkshire’s $90 billion unrealized gain in Apple was 17% of Berkshire’s market cap at the end of 2020).

Ted Williams has a strong case for the best hitter of all time, using modern statistical analysis. The only hitter that stood out more from his peers was Babe Ruth, who played in an era where the variation in hitting was much higher. By the time Ted Williams started playing in the 1940s, variation had settled down to modern levels, according to the statistics Gould compiled.

“Buy, borrow, die” refers to the idea that rich people easily avoid taxes by borrowing against their investments instead of selling them and paying taxes on the profits. Some people do it, but it is a dangerous game. Shelby Davis got away with it, but the son of GEICO founder Leo Goodwin, at one point estimated to be one of the twenty-five richest people in America, was forced to file for Chapter 11 bankruptcy protection when GEICO’s stock crashed in 1976 because he had borrowed against his shares.

How do you explain the money managers still on the list? 2&20 is steep, but I assume you still need great returns over an extended period to make the Forbes list from it.

One strange thing about Buffett, is that he didn’t charge a % of the incredible alpha he was producing for his investors. Maybe that is what’s really rare: most investors with alpha will charge for it.

Fascinating and insightful, thank you. I think Buffett himself would take issue with your definition of him as a completely passive investor, and would also point out that a number of his early investments were private companies. What's so interesting about the history of Berkshire Hathaway is how Buffett created such a hybrid business model: part investment partnership, part insurance company, part private equity buyout firm, part industrial conglomerate. It's hard to dispute that he was a passive investor in most of his investments, but there are many where he and his partners played outsized roles at board level and were even highly active in the day-to-day running of the underlying businesses.